All Categories

Featured

Table of Contents

If you're somebody with a low tolerance for market variations, this understanding might be important - Indexed Universal Life policy. One of the important aspects of any type of insurance policy is its price. IUL plans usually come with numerous charges and costs that can impact their general worth. A monetary consultant can damage down these prices and aid you evaluate them against various other low-cost financial investment choices.

Do not simply think about the premium. Pay specific interest to the policy's functions which will be necessary relying on exactly how you want to utilize the policy. Speak with an independent life insurance agent that can help you choose the very best indexed universal life plan for your requirements. Complete the life insurance policy application completely.

Evaluation the policy meticulously. Currently that we have actually covered the advantages of IUL, it's important to understand how it contrasts to other life insurance coverage policies readily available in the market.

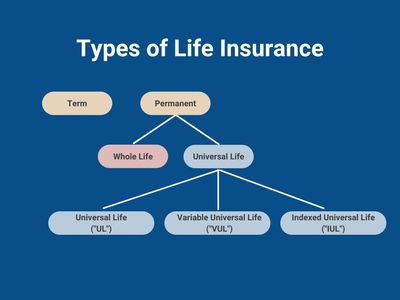

By recognizing the resemblances and differences between these policies, you can make a much more educated decision about which sort of life insurance coverage is finest suited for your demands and monetary objectives. We'll start by comparing index global life with term life insurance policy, which is typically taken into consideration the most uncomplicated and affordable kind of life insurance policy.

Who are the cheapest Indexed Universal Life Account Value providers?

While IUL may offer higher possible returns as a result of its indexed money worth growth device, it likewise features higher premiums compared to describe life insurance policy. Both IUL and whole life insurance coverage are kinds of permanent life insurance plans that give fatality advantage protection and money value growth possibilities (Indexed Universal Life growth strategy). Nonetheless, there are some vital differences between these 2 sorts of plans that are necessary to take into consideration when making a decision which one is right for you.

When thinking about IUL vs. all various other sorts of life insurance policy, it's important to consider the pros and cons of each policy kind and talk to a seasoned life insurance policy agent or financial consultant to determine the finest option for your special needs and monetary goals. While IUL offers numerous benefits, it's also essential to be conscious of the risks and factors to consider associated with this kind of life insurance policy policy.

Let's dig deeper into each of these dangers. One of the primary problems when considering an IUL policy is the various prices and fees related to the policy. These can include the expense of insurance policy, policy fees, surrender costs and any kind of additional biker prices sustained if you add fringe benefits to the plan.

Some might offer much more competitive prices on insurance coverage. Examine the financial investment choices offered. You want an IUL plan with a variety of index fund selections to fulfill your demands. See to it the life insurer lines up with your personal economic objectives, demands, and risk tolerance. An IUL policy need to fit your specific circumstance.

How do I compare Guaranteed Indexed Universal Life plans?

Indexed universal life insurance can offer a number of benefits for insurance holders, including adaptable premium settlements and the prospective to earn greater returns. The returns are limited by caps on gains, and there are no warranties on the market efficiency. All in all, IUL policies offer a number of potential benefits, but it is crucial to understand their threats.

Life is not worth it for the majority of individuals. For those looking for predictable lasting financial savings and guaranteed death advantages, whole life may be the better option.

Why should I have Iul Investment?

The advantages of an Indexed Universal Life (IUL) plan consist of potential greater returns, no drawback threat from market movements, defense, flexible repayments, no age demand, tax-free survivor benefit, and finance availability. An IUL plan is permanent and provides money worth development with an equity index account. Universal life insurance coverage started in 1979 in the United States of America.

By the end of 1983, all major American life insurers supplied global life insurance policy. In 1997, the life insurance firm, Transamerica, presented indexed global life insurance policy which provided insurance policy holders the ability to link policy development with international stock exchange returns. Today, universal life, or UL as it is additionally known comes in a variety of different types and is a huge part of the life insurance policy market.

The details given in this short article is for academic and informational functions only and need to not be understood as monetary or investment advice. While the author has experience in the subject matter, viewers are advised to speak with a qualified monetary consultant before making any type of investment decisions or purchasing any type of life insurance policy items.

Who provides the best Guaranteed Indexed Universal Life?

In reality, you might not have believed much regarding just how you want to spend your retired life years, though you probably understand that you do not intend to lack money and you want to keep your present lifestyle. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text shows up next to the company man speaking to the cam that reads "firm pension", "social protection" and "savings"./ wp-end-tag > In the past, people depended on three main incomes in their retired life: a company pension plan, Social Safety and security and whatever they would certainly managed to save

Fewer companies are offering traditional pension. And lots of business have actually decreased or ceased their retirement strategies. And your capability to depend exclusively on Social Protection remains in inquiry. Even if advantages haven't been minimized by the time you retire, Social Security alone was never intended to be enough to spend for the lifestyle you want and deserve.

Before devoting to indexed global life insurance policy, here are some benefits and drawbacks to think about. If you select an excellent indexed universal life insurance coverage plan, you might see your cash worth expand in value. This is practical due to the fact that you might have the ability to access this money before the strategy ends.

What types of High Cash Value Indexed Universal Life are available?

Considering that indexed global life insurance requires a particular degree of threat, insurance policy business have a tendency to maintain 6. This kind of plan additionally offers.

If the selected index doesn't carry out well, your cash value's development will certainly be influenced. Usually, the insurer has a vested rate of interest in carrying out far better than the index11. There is usually an ensured minimum rate of interest price, so your plan's growth won't fall listed below a certain percentage12. These are all variables to be thought about when selecting the ideal kind of life insurance for you.

Considering that this type of policy is a lot more complicated and has an investment part, it can often come with higher costs than other policies like whole life or term life insurance. If you don't assume indexed universal life insurance coverage is ideal for you, below are some alternatives to consider: Term life insurance policy is a temporary policy that typically uses coverage for 10 to 30 years

Table of Contents

Latest Posts

Index Linked Term Insurance

Iul Benefits

Universal Life Company

More

Latest Posts

Index Linked Term Insurance

Iul Benefits

Universal Life Company